Kid Compass is a newly launched web app for kids (by Jeremy Hodge) that makes chores, allowance, saving, and investing easy to learn and fun to discuss. It’s already sparking powerful, practical money conversations at home.

Kid Compass: Our Family’s New Adventure in Money (and Life) Skills

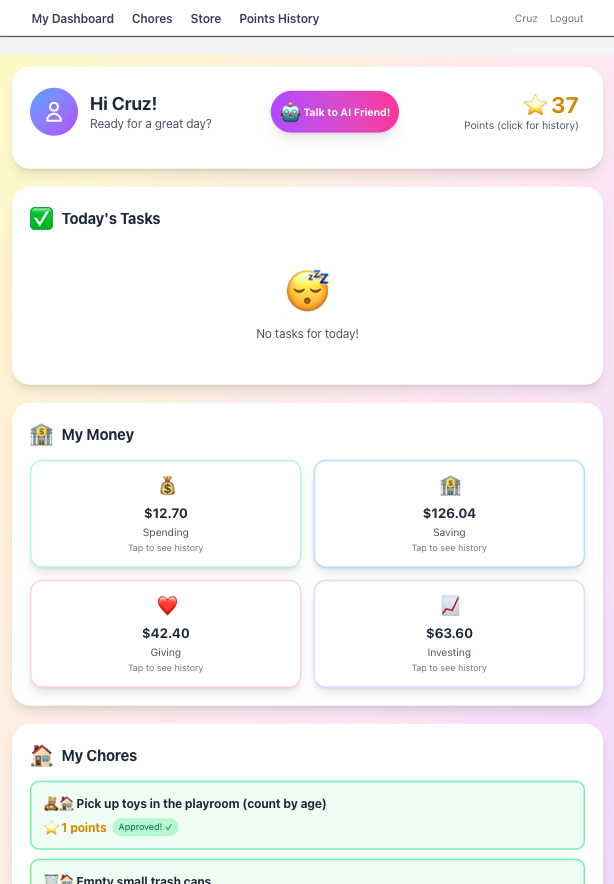

This week marks a big milestone for our family—and, frankly, my inner tech geek. I just launched the Kid Compass webapp for my kids (ages 9 and 6), and within days, it’s already transformed how we talk about money, habits, and helping around the house.

Why Kid Compass?

Like most parents, I want my kids to grow up confident with money—not just stashing coins in a jar, but actually understanding where their money goes and how small choices add up over time. Kid Compass was designed as a simple, family-friendly app to make those lessons visible:

- Allowance Tracking: Each child has their own digital “banks” for spending, saving, investing, and giving. (We use a simple formula: their age × 2, split across the four categories.)

- Daily Checklists: No more nagging—just two simple routines each day, and points when they actually make their bed or brush their teeth without reminders. Chores are kid-claimable, and rewards are tangible.

- Chore & Points System: Kids can pick their tasks, earn points based on difficulty, and convert those points into privileges or even a little cash.

Conversations That Matter

What surprised me most: launching Kid Compass sparked a wave of unexpected conversations. The kids started asking about:

- Why does saving matter?

- How does investing work (and why isn’t “spending” the only category)?

- What’s actually worth earning points for?

They even started setting goals (“I want to save up for that LEGO set—how long will it take?”) and helping each other make smart choices. Yes, there have been debates about the fairness of point values for chores, but—honestly—that’s half the learning right there.

Tech That Keeps It Simple

Kid Compass is all about visibility: every allowance deposit, every point earned, and every reward-claim is tracked and logged.

Early Wins—and What’s Next

We’re only a week in, but here’s what I’m already seeing:

- Confidence: The kids are more aware (and proud) of their choices.

- Openness: Conversations about spending vs. saving don’t feel awkward—they feel normal.

- Engagement: Chores are (not magically, but steadily) less of a battle.

I built Kid Compass for my own family, but I think these lessons—visibility, empowerment, and a dash of fun—could help a lot of others. If you’re interested, keep an eye out: I’ll be sharing more about our journey (and maybe opening up beta access) soon.

If you have questions about how the allowance or point system works, drop a comment—or just ask your nearest 9-year-old finance guru. They might surprise you.

Want to see Kid Compass in action or learn more?

Let me know! I’m already learning a ton, one dollar (and one chore) at a time.

Leave a Reply